Money Matters is written as menu of personal finance, investing and entrepreneurship life skills so that readers can map the learning objectives and activities in it to their interests.

The book is:

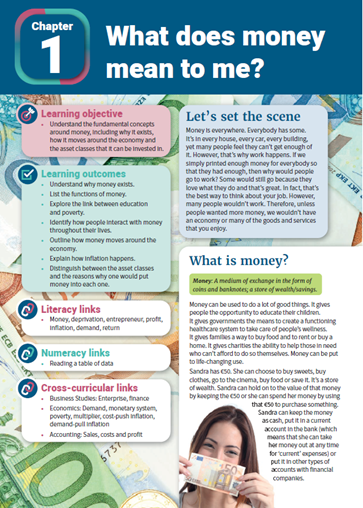

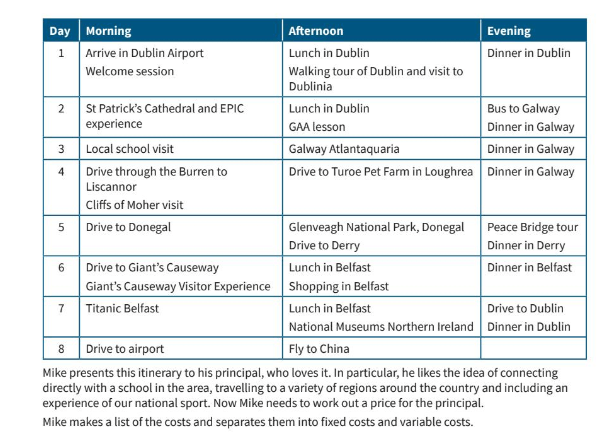

- story focused whereby readers can learn about pensions through Sarah who starts her first job and is wondering what “tax relief” means for her or Aleksander who signs up for a store credit card while working abroad for a Summer and pays the price or Mike who wonders how to make his side hustle profitable

- full of relevant modernity including ESG, fintech, online brokers, differentiating between trading and investing as well as using technology for active learning.

- illustrative of the diversity of careers in finance. Each chapter contains a case study of a charterholder and highlights accounting, business, maths and economics can really come to life.

It is available for sale for €12.50 with free delivery in Ireland

Here are my top ten ways to use the book:

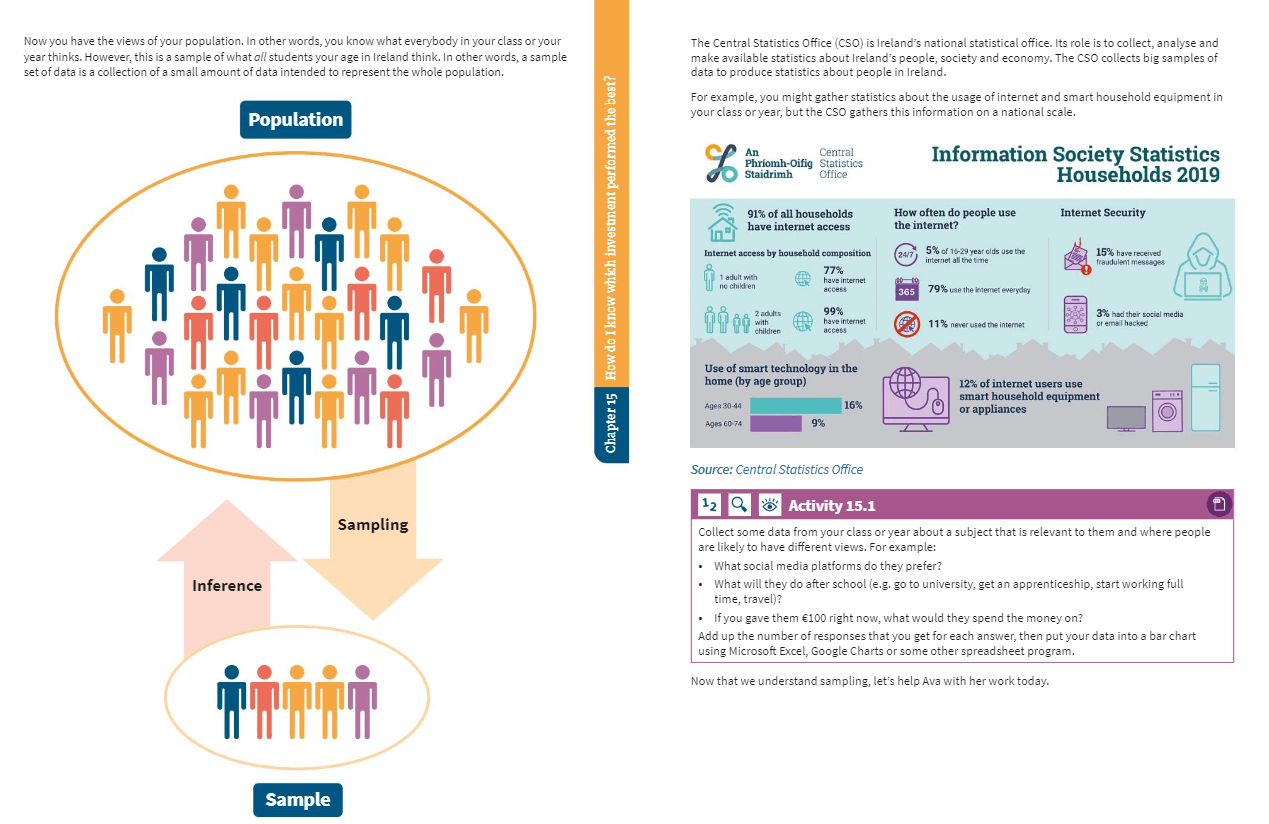

5. Let market research speak volumes

One of the best things an entrepreneur can do, independent of age, is to learn how to listen to the market. An economist has to gather data all the time to discern trends and comment on the changes they see in the world around them. Therefore, building market research skills early is super useful. Activity 15.1 on page 132 explains exactly how to do that.

6. Use the T.V. as your teacher!

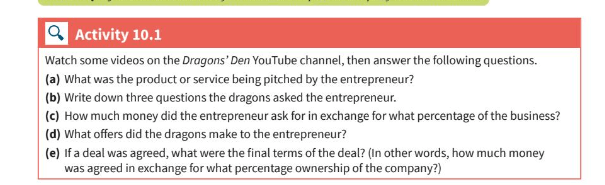

Speaking of market research, as we talked to people about what they wanted to find in this book, some told us that they really enjoyed shows like Shark Tank and Dragon's Den. These productions can teach us a lot about what investors want to see in a business, the questions that business people have to answer and how the accounts can make or break a deal. Using Activity 10.1 on page 79 or Activity 12.4 on page 105 can turn you into a passive participant to a critical thinker!

8. Build a paper portfolio

One of the best ways to really learn about the stock market is to put together a paper portfolio and track the share prices on a regular basis. Google Sheets enables you to do this in realtime, for free and using real data. Watch your shares go up and down so that you can truly get a sense of what it's like to put real money into the market.

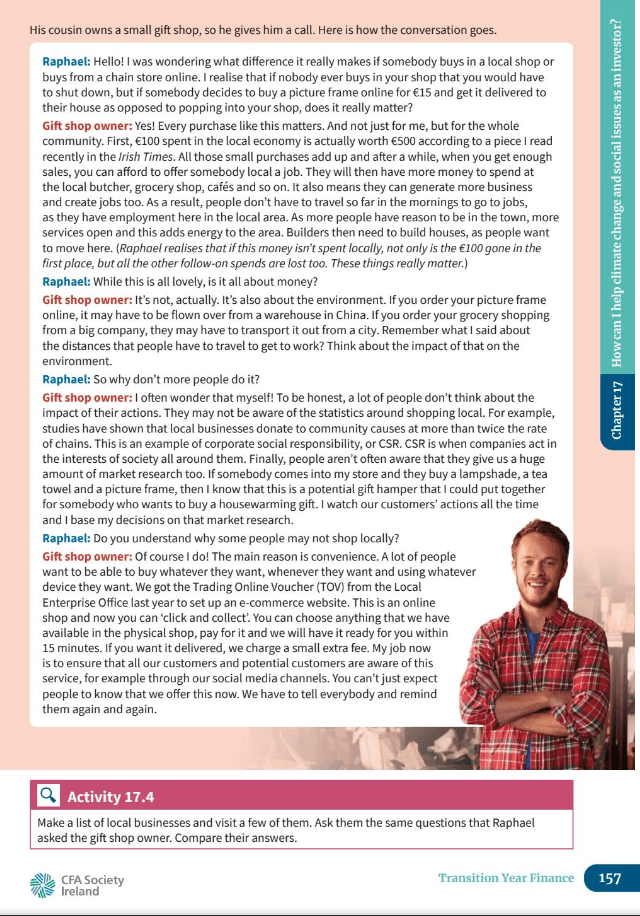

9. Fan the flames of local pride

People love to talk about where they're from and what makes them proud of where they live.